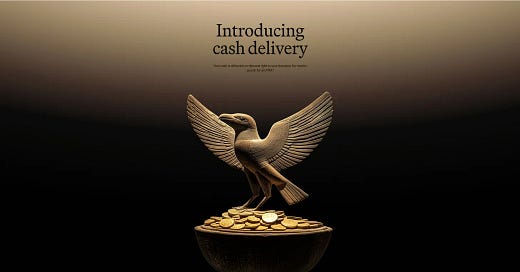

When “Bad Features” Win: The Acquisition Strategy Behind Robinhood’s Cash Delivery

Why a slow, costly feature may be the smartest customer acquisition move in fintech.

TLDR: Robinhood’s new Cash Delivery by Mail service looks inefficient on the surface: slow, costly, and out of sync with a cashless economy.

This launch isn’t about product improvement. It’s a strategic move to acquire a new demographic: older, wealthier customers who still value physical cash interactions.

In this breakdown, we’ll see why product development disguised as customer acquisition can outperform ‘better features’ when expanding into new markets.

Robinhood’s Expansion Challenge

Robinhood has always excelled at serving a very specific audience:

Young, tech-savvy investors are drawn to innovative product features such as commission-free trading, sleek mobile interfaces and easy access to financial markets

But this audience comes with natural limits:

Smaller average account balances

Higher platform churn

Lower resistance to trying competing apps

Robinhood needs to win the user segment of older, wealthier customers with more assets and longer financial lifespans.

That’s the only path to scale into a dominant financial institution.

And that requires more than better UX or marginally improved features.

It requires building trust.

A Product Launch Disguised as an Acquisition Tactic

In 2025, Robinhood introduced Cash Delivery by Mail:

A service that lets users withdraw funds and receive physical cash directly via mail.

At first glance, it seems almost counterintuitive.

Cash is declining.

Mobile payments are rising.

Fintech is about speed and convenience.

That’s exactly why this decision is so smart.

Robinhood isn’t optimizing for operational efficiency or product innovation here.

They’re creating a familiar, tangible experience for a cohort that still associates trust with physical, real-world transactions.

In other words:

This is not a feature built to delight their current users.

It’s a feature built to attract users they don’t have yet.

By meeting older users where they are, even at a financial and operational cost, Robinhood sends a subtle but powerful signal:

We understand the way you interact with money.

You can trust us with yours.

Why Better Features Alone Won’t Expand Your Market

Many teams think growth comes from adding “better” features, faster payment processing, smoother interfaces and lower fees.

Those improvements matter.

But they mainly help you serve the customers you already have.

Expanding into new segments often requires something else:

Solving emotional friction points

Reframing your platform to feel familiar or safe to outsiders

Offering trust-building experiences, not just better tools

Sometimes, the most effective growth strategy is to sacrifice operational efficiency for emotional efficiency temporarily.

Emotional Efficiency:

The speed at which someone feels comfortable enough to adopt your platform.

The Path to Becoming a Financial Hub

Cash Delivery by Mail isn’t a one-off experiment.

It’s part of a much larger strategic transformation.

Robinhood isn’t just trying to be an investing app.

They are methodically positioning themselves to become a one-stop shop for financial life, offering banking services, retirement accounts, credit cards, and more.

Their long game:

Acquire users across different life stages

Expand the share of wallet over time

Build retention through embedded financial products

Create a default financial operating system for individuals worldwide

In that model, every new feature isn’t simply judged by its immediate user adoption.

It’s judged by how effectively it moves users closer to anchoring all their financial activity inside Robinhood.

Key Takeaway

Not every product launch needs to optimize for your current users’ convenience.

Sometimes, the highest-leverage product decisions are the ones that create strategic bridges to new customer segments, even at short-term operational cost.

Building features that feel inefficient but signal belonging, familiarity, and emotional trust can be one of the most effective expansion levers in competitive industries.

Apply This to Your Business

Audit your growth initiatives: Are they just making your current users happier, or are they expanding your addressable market?

Identify high-potential user groups you’re not yet winning.

Find emotional friction points (not just technical ones) that keep them away.

Build products or experiences that meet them where they are, even if it feels inefficient on paper.

Measure success not just by feature usage, but by the new types of users you attract and retain.

Value Frame is a newsletter breaking down the strategies and growth hacks that built the world's greatest companies to help you understand what worked and build what's next.