From Gig to Robot: My Bet on Self-Driving Cars Over Uber

Let's find out why Uber’s biggest money-making trick could be destroyed overnight.

TLDR:

Robotaxis threaten to dismantle Uber's gig economy model by eliminating its driver-dependent network, with Tesla's vertically integrated, AI-driven approach poised to dominate the autonomous ride-hailing market.

As Uber pivots to become a super app for travel and mobility, its reliance on partnerships rather than owning autonomous technology leaves it vulnerable, while

Tesla’s scalable, cost-efficient robotaxi network could redefine transportation, logistics, and urban economics.

Uber is no longer just a ride-hailing company, it’s strategically becoming an end-to-end travel and mobility platform.

Its biggest competitive assets?

A highly engaged global customer base

That’s why Uber is aggressively expanding beyond transportation, integrating services like food delivery (Uber Eats), freight logistics, and even travel booking.

But there is more. Uber’s goal to acquire Expedia could accelerate its transition into a Super App for human movement. It probably won’t happen. But we see Uber’s intentions.1

If this happened, Uber could position itself as the ultimate travel and mobility platform, seamlessly handling:

Flights & Hotels (via Expedia)

Rides (Uber)

Food & Dining (Uber Eats, OpenTable partnerships)

Event Tickets & Experiences (Uber Explore)

How Robotaxis Could Kill Uber’s Ride-Hail Business

Uber’s entire business model is built on a fragile balance:

Drivers supply the fleet: Uber doesn’t own the cars, making it asset-free.

Surge pricing boosts margins: Dynamic pricing maximizes revenue.

Scale creates network effects: More riders = more drivers = faster matching times.

But robotaxis breaks this model entirely.

If autonomous fleets eliminate the need for drivers, Uber’s biggest advantage, its vast driver network, becomes obsolete.

Uber’s Biggest Risk: Autonomous Disruption

Cost per Mile Drops Drastically

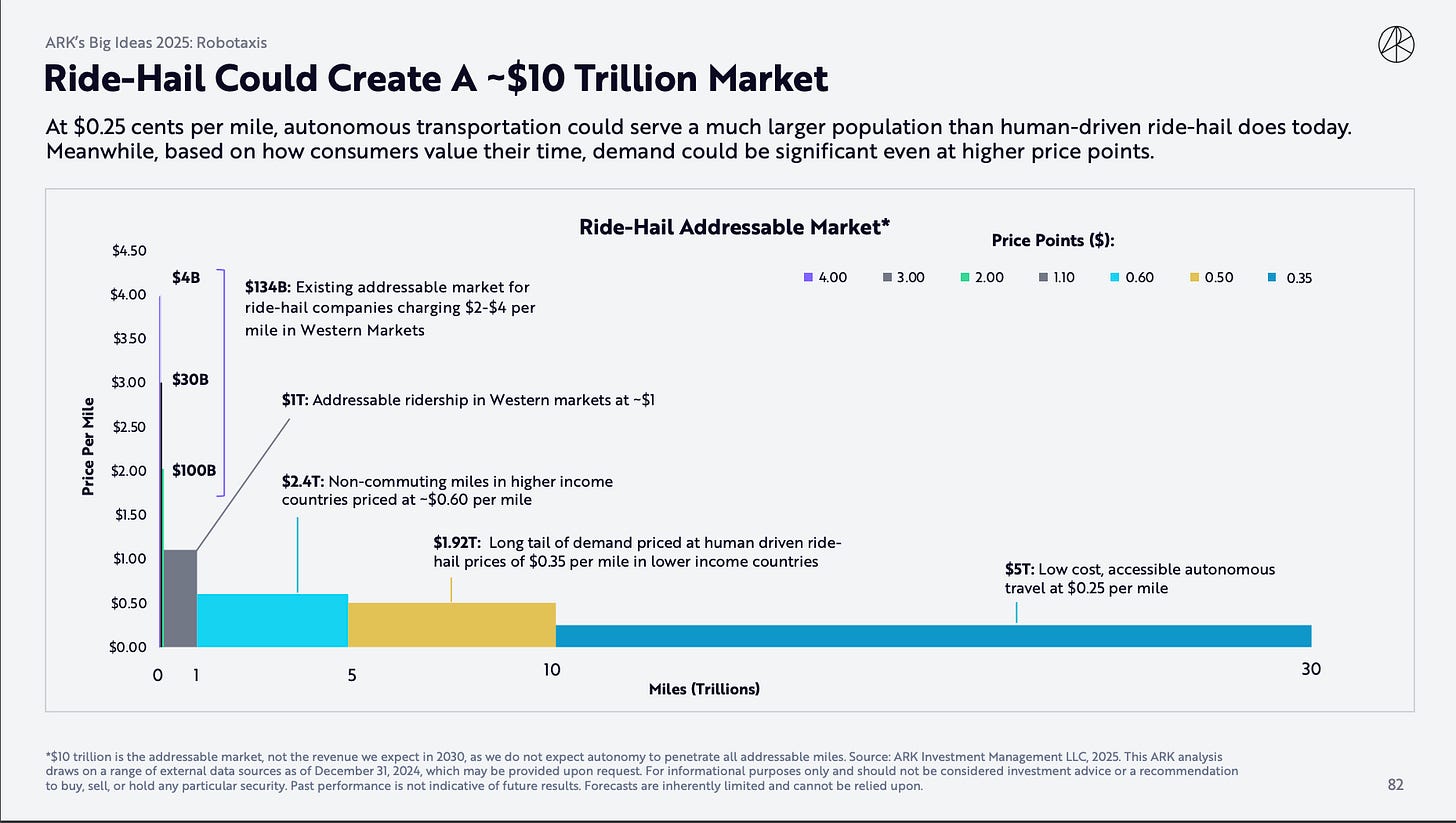

Uber’s fares today are $1.8–$4 per mile, largely due to driver compensation (~60% of the cost). Autonomous ride-hail could cut this to $1 per mile, making Uber’s driver-dependent model wildly uncompetitive.

No More Drivers = No More Margins

Uber doesn’t own cars, it depends on drivers. Uber's model collapses when Tesla, Waymo, or another competitor launches a fully autonomous fleet at scale.

A Fully Integrated Robotaxi Network

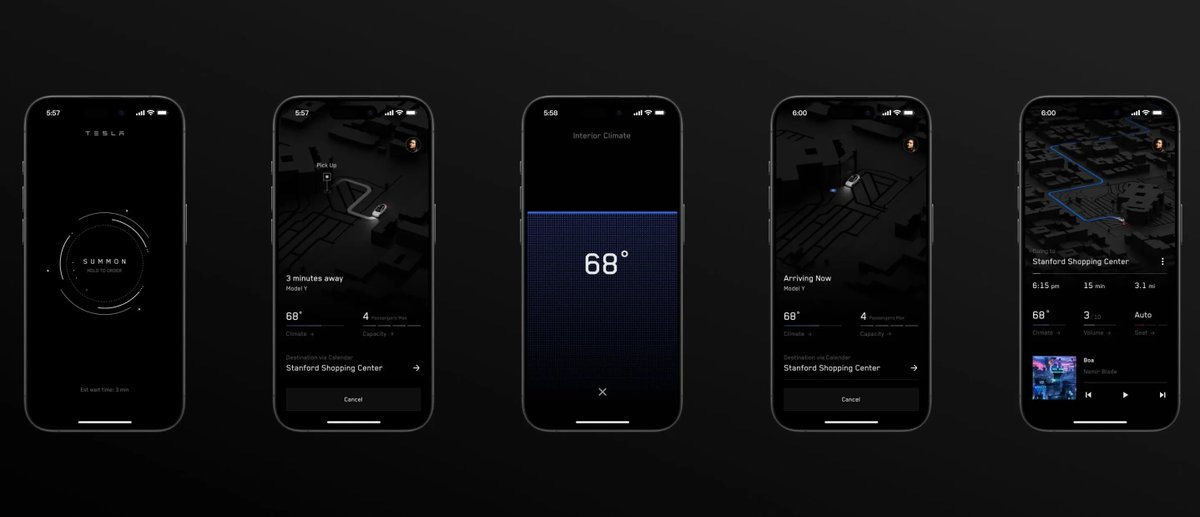

With a simple software update, Tesla could activate millions of existing vehicles overnight as robotaxis. When that happens, Uber will lose its dominance because Tesla would own both the supply (cars) and the demand (users via app integration).

Uber without drivers = No revenue model

Robotaxi fleets = More reliable, cheaper, and always available

If Uber can’t pivot, it risks becoming irrelevant in the autonomous era.

Uber’s Challenge in Autonomy

Despite these threats, Uber is not leading the race to autonomy and here’s why:

It doesn’t own its fleet or the required software

It depends on third-party partnerships for self-driving tech

Uber has partnered with Waymo (Alphabet’s self-driving division) to integrate robotaxis into the Uber app to stay competitive.

Meanwhile, Lyft is taking a similar route, teaming up with Mobileye to deploy autonomous vehicles.2

But there are a few problems:

Every partnership adds cost and complexity to Uber’s business model.

Uber doesn’t own the autonomous technology, making it vulnerable to external providers.

Without vertical integration, achieving long-term profitability is a challenge.

So while Uber aims to be a Super App for Travel Experiences, it may never truly be a part of the future of autonomy.

The New Business Models of the Autonomous Era

Autonomy will reshape Uber's operations in other sectors beyond ride-hailing. If robotaxis replace human drivers, what will happen to food delivery, freight logistics, or package delivery?

Autonomous Food Delivery: Uber Eats could pivot to self-driving food pods that navigate to customers’ locations without drivers. Kitchens could be decentralized, using AI to optimize food preparation and delivery in real time.

Logistics and Freight: Uber Freight relies on human-driven trucks, but autonomy could make on-demand freight logistics cheaper and faster. Fully automated trucks could reduce delays and optimize supply chains in ways human drivers never could.

On-Demand Mobile Services: Imagine autonomous vehicles doubling as mobile convenience stores, medical testing units, or remote workspaces. A fleet of robotaxis could deliver services directly to people rather than transporting them to a service location.

Entertainment on the Move: If mobility becomes effortless and cost-efficient, new forms of in-transit entertainment could emerge—turning robotaxis into mobile cinemas, co-working spaces, or even gaming lounges.

Autonomy isn’t just about replacing drivers; it’s about rethinking how services are delivered when vehicles drive themselves.

Waymo vs. Tesla

Two companies are leading the race for fully autonomous ride-hailing in the US: Waymo and Tesla.

Waymo’s Strengths & Weaknesses

High-cost LiDAR sensors for precise mapping (~$40K–$50K per car)3

Geofenced operations: meaning it only works in pre-mapped and super-controlled cities (Construction sites change the map and sensors lose their eyes)

While Waymo is ahead in safety and regulatory approvals, its biggest weakness is scalability. Building out a self-driving network one city at a time is costly and slow.

Tesla: The Vertical Integration Checkmate

Tesla’s strategy is different. Instead of relying on expensive LiDAR or geofenced maps, Tesla is building an end-to-end, vision-based AI system designed to operate anywhere.

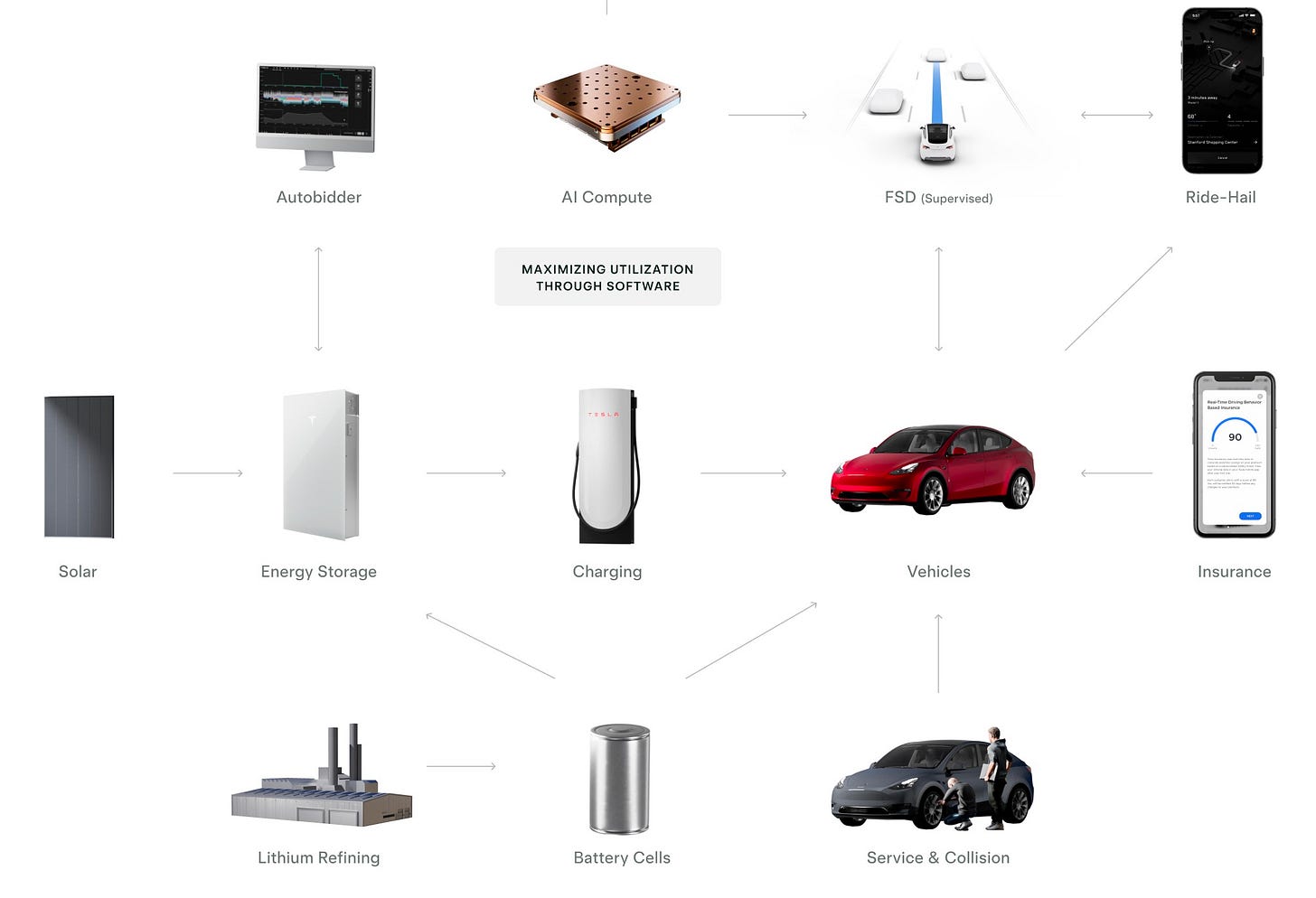

Lowest Cost Structure: Tesla owns everything: vehicle production, software, AI training, and even insurance. This allows it to scale autonomously without expensive partnerships.

Vision-Based AI: Unlike Waymo’s costly LiDAR geofencing, Tesla’s neural-nets camera-based self-driving system is designed to operate anywhere in the world.

Fleet Monetization: Tesla owners won’t just buy cars, they’ll own assets. A software update could instantly convert millions of Teslas into money-printing robotaxis, just like Airbnb turned spare rooms into revenue streams. This June in Austin, they will launch their robotaxi service, expecting to expand to more cities a few months after that.

AI Simulation Risk: If AI can simulate Tesla's real-world data, the uniqueness of Tesla's FSD could be commoditized, diminishing its competitive edge and resulting in the loss of all of its revenue potential and decades-long research and development.

Bottom line?

Tesla isn’t just building cars, it’s creating the most cost-efficient, scalable, and profitable autonomous ride-hailing network.

The Market Impact of Autonomous Ride-Hail

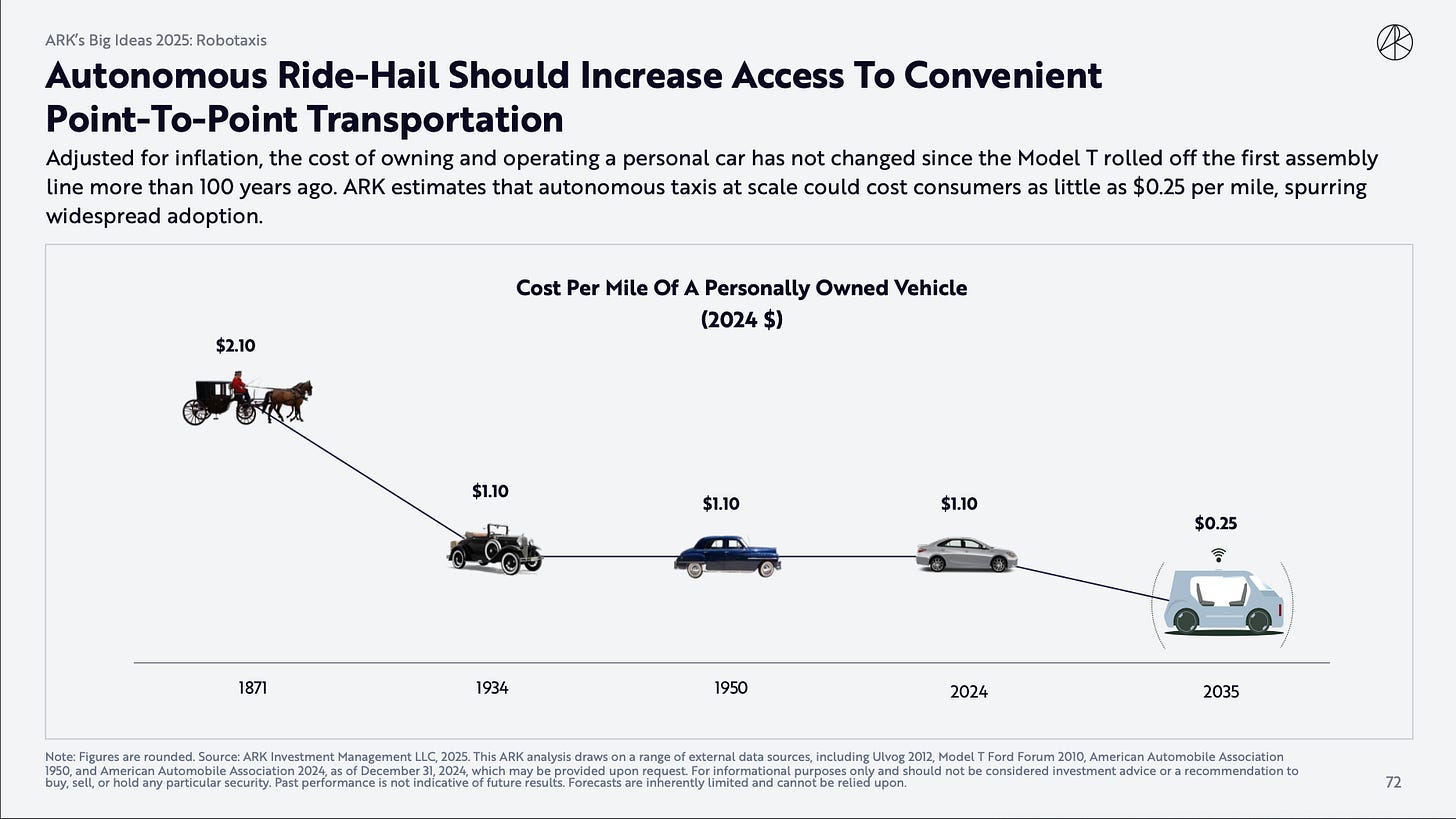

According to ARK Invest4, autonomous ride-hailing (robotaxis) could slash transportation costs, reducing the cost per mile to just $0.25.

This cost reduction could unlock a $10 trillion market.

Revenue Models in the US

Uber (Human-Driven Ride-Hail)

~$1.84 per mile with human ride-hailing

Takes a 30-60% cut of driver earnings

Surge Pricing Strategy

Transition to autonomous fleets via partnerships

Waymo (Google’s Autonomous Ride-Hail)

Higher fares than Uber in most cases, often 30-100% more expensive5

No tipping requirement, but slower ride times (33 min vs. 15 min for Uber)

Struggles to lower prices due to:

Hardware costs and reliance on expensive sensor suites

Slow scaling, preventing significant reductions in operational expenses

Uber partnership limits its ability to control pricing and market expansion

Tesla (Robotaxi Network)

Cybercab Strategy: Tesla plans to sell a dedicated robotaxi, the Cybercab, profitably at ~$30,000, making it far more affordable than Waymo’s costly, custom-built autonomous vehicles.

Low-Cost, Decentralized Model: Tesla’s decentralized model cuts costs by using privately owned vehicles. This enables rapid scalability, as any Tesla owner can join the Robotaxi network, unlike Waymo’s fleet-based expansion.

FSD Subscription Model: Instead of absorbing high upfront hardware costs like Waymo, Tesla will generate recurring revenue via FSD subscriptions, allowing owners to monetize their vehicles within the network.

Projected Cost Advantage: Targeting > ~$1 per mile (rough estimate), significantly cheaper than Waymo’s premium pricing model.

Price Flexibility: Since Tesla doesn’t operate as a traditional fleet owner, it can achieve lower operational costs and pass savings directly to users, avoiding the pricing struggles Waymo faces.

What Will Happen Next

Uber will try to win the Super App race by consolidating ride-hailing, travel, and logistics into one seamless platform. However, high operational costs will make it unable to compete.

Waymo will remain a historic but relatively small player in geofenced, high-safety autonomous transport, and it will struggle to scale.

Tesla will win the autonomous ride-hailing war by leveraging its fleet, AI, and cost efficiency to outcompete legacy models.

This is why Tesla isn’t just another car company, it’s an AI & robotics company positioned for the biggest transportation disruption in history.

The robotaxi race isn’t just about who’s first, it’s about who scales best.

My 3 Takeaway Strategies

1. Watch Your Foundation

Learning from Uber vs. Robotaxis: Beware of building on fragile assumptions

Key Move: When your core advantage (e.g. driver network) can be disrupted, pivot early

How to Win: If you can't own the disruption, partner strategically horizontally to play to win in different markets

2. Vertical Integration Dominates

Learning from Tesla vs. Waymo: Full integration beats partial solutions

Key Move: Own your entire value chain - hardware, software, and distribution

How to Win: Build once, monetize multiply (e.g. Tesla's cars becoming part of the robotaxi network)

3. Win a Position in a Better Future

Learning from Tesla vs. Uber: Position for the $10T autonomous market

Key Move: Focus on owning tomorrow's profit pools, not today's revenue streams

How to Win: Build foundational tech (AI, robotics) that enables future business models. (Yes, it can be simpler than robotics. Dive into your “niche”)

Personal Note

This market insight is why I invested in Tesla in 2021.

While most people saw Tesla as just an EV manufacturer, I saw it as a data-driven AI powerhouse.

Tesla’s robotaxi shift will reshape mobility and disrupt urban economics, logistics, and the concept of car ownership.

If Tesla executes, it won’t just compete with Uber and Waymo, it will redefine transportation as we know it.

This is not financial advice. I hope this is only the spark to start researching about the impact of emerging technologies like autonomous vehicles in the world.

See you in 2035 🫡